Loading...

Need to borrow some cash? Loanz is an online lender that can send up to $15,000 over to you in minutes if you qualify and read the fine print.

Loanz is looking at lending to Canadians who may need an infusion of funds to pay bills, consolidate debt, cover a wedding, or finance a trip, among other things. Others may want the money for home improvement jobs or an unexpected expense where timing is of the essence. Rather than walking into a brick-and-mortar location, or getting on the phone, Loanz can do it all online.

Don’t confuse Loanz with a payday lender, says Paul Hadzoglou, the company’s president. The premise may seem familiar if you’ve ever dealt with businesses like that, but the focus appears to differ. For one, you need to be earning an income that your employer deposits in a bank account to be eligible. All Canadians over 18 are eligible, so long as they have a valid ID to go with that bank account.

Credit scores are a lot more forgiving here, so unlike a bank, yours doesn’t have to be high to get approved. Primary loans come in 12-month or as long as 60-month terms, with interest rates ranging from 29-46%, depending on your credit history and ability to pay it back.

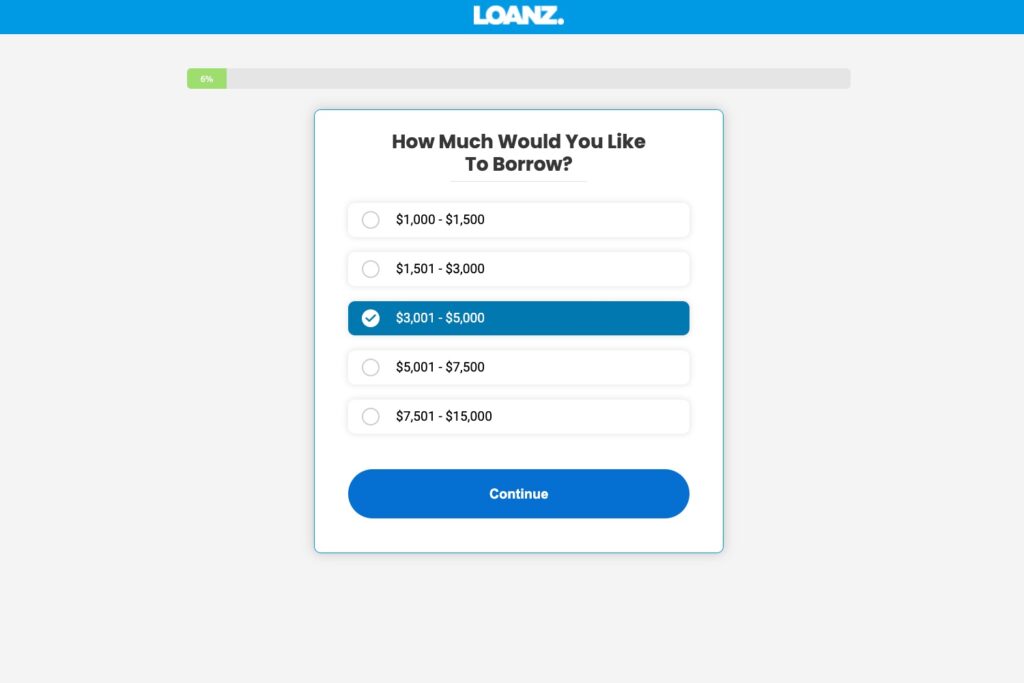

You can borrow from $1,000 to $15,000 (or more in some cases), which you select once you log in to the site. These are installment loans designed for longer-term repayment, as opposed to payday loans that are short-term and compound quickly if there’s any delay in paying them back.

Installment loans usually come in larger amounts and for longer terms than payday loans. Payday lenders cornered the market on smaller sums, typically in the hundreds of dollars. A lender like Loanz focuses on larger amounts that borrowers would ostensibly be able to pay back because they’re already employed and have means to make installment payments.

Since the application is entirely online through the website, it can take only a few minutes to go through the process. While there is no dedicated app, it’s possible to go through it all on a smartphone or tablet using a browser. The site is barebones from the start, where you select and fill out information as you go along.

For instant pre-approval, you would need to connect your bank account to receive the money in one of two ways. Hadzoglou says Loanz can send the funds in in minutes through Interac e-transfer, or via direct deposit to the account, with a delay of one or two business days. Approvals and funding take place 24 hours a day, seven days a week, he says.

It’s less about about how much money you have in the bank, and more about the fact you’re actually earning income your employer deposits into that account. If you’re earning cash as, say, a server, you may still be eligible so long as wages get paid into your account.

Loanz offers repayment plans between 12-60 months, regardless of the amount. As with any loan, the longer you take to pay it back, the more interest you add to the total. The annual percentage rate (APR) doesn’t change by the borrowed amount, though it can based on your credit profile and ability to repay. That’s why there’s a range between 29-46%.

Borrowers can pay back the loans early to save on interest, and without any pre-payment penalties. As a borrower, you’re not obligated to only pay the installment for any particular month. You’re not limited in how much more you want to pay, and whatever you do add goes against the principal. It’s like making a lump sum payment toward a mortgage or financing a vehicle.

Loanz doesn’t garnish wages when borrowers are in arrears. Instead, it works through collections using a curation approach to help the customer work through paying the loan back. If it gets really bad, a collections agency may come chasing after the debt.

Gradually reducing the principal to eventual full repayment is meant to end the credit cycle. A face value, it suits the mission to give credit to all Canadians at “reasonable rates” to help them get out of a debt cycle. Hadzoglou says Loanz can help consumers can start to gain financial freedom this way.

To be clear, an interest rate between 29-46% is high by any standard. Only when you compare it to a payday loan, where the APR can reach percentages of up to 500%, an installment loan might feel like more of a bargain. Certainly not as good as a line of credit from a bank, where interest rates are lower than credit cards.

The value add for Loanz is that you don’t have to go through the rigorous process of getting the money. But to get it, you are paying a premium for the convenience. Its interest rates are on par with credit cards, only the difference is you don’t have access to additional credit. Once Loanz gives you the full amount, you can’t dip in to more.

To make this work, it’s probably best to plan repayment as quickly as possible to save money on interest. Otherwise, the loan becomes considerably more expensive than the initial principle. Being able to avoid a pre-payment penalty helps incentivize borrowers to pay it off sooner, rather than later.

To ‘GetConnected’ to our newsletter, fill out the details and hit the ‘SUBSCRIBE’ button. We do require you to confirm your email.